Understand how offshore trusts asset protection can shield your assets from litigation.

Understand how offshore trusts asset protection can shield your assets from litigation.

Blog Article

Checking out the Advantages of Offshore Count On Asset Protection for Your Wealth

When it concerns securing your riches, offshore trusts can supply considerable advantages that you may not have actually thought about. These trusts provide a calculated layer of security against creditors and legal insurance claims, while additionally improving your privacy. Plus, they can open up doors to distinct financial investment possibilities. Curious about how these benefits can affect your monetary future and estate planning? Allow's discover what offshore counts on can do for you.

Comprehending Offshore Trusts: A Primer

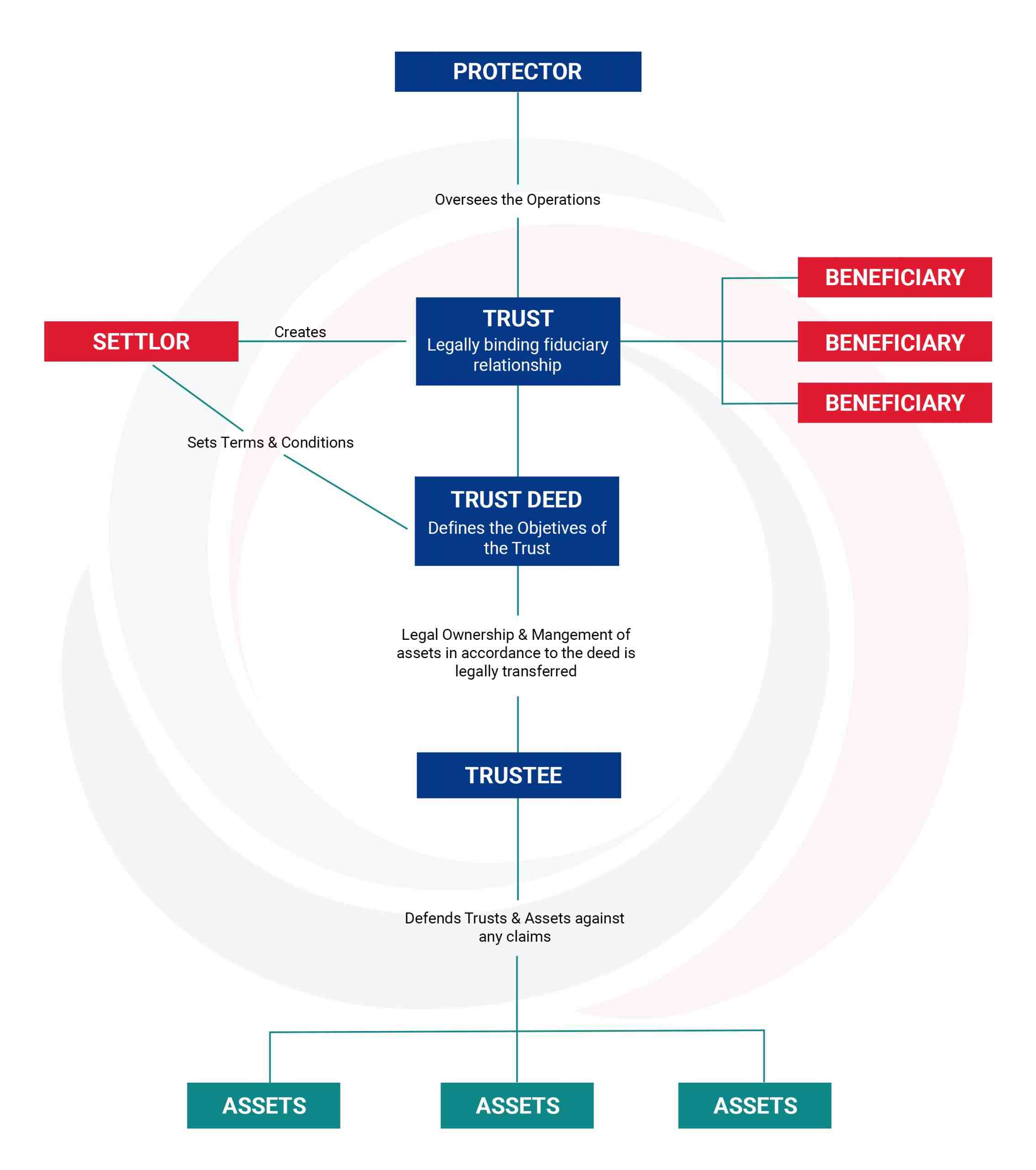

Offshore counts on supply a special way to manage and safeguard your possessions, and understanding their basics is essential. These depends on enable you to put your wide range outside your home country, typically in jurisdictions with favorable tax obligation regulations and privacy securities. When you established an offshore trust fund, you're basically transferring your possessions to a trustee, who manages them according to your defined terms. This framework can assist you keep control over your wealth while lowering exposure to local obligations and tax obligations.

Furthermore, overseas trusts frequently offer discretion, shielding your monetary events from public examination. By realizing these fundamentals, you can make enlightened decisions concerning whether an offshore depend on straightens with your asset security method and long-term economic objectives.

Lawful Protections Supplied by Offshore Trust Funds

When you establish an overseas trust fund, you're taking advantage of a robust framework of legal protections that can protect your properties from numerous risks. These trusts are typically governed by favorable regulations in overseas jurisdictions, which can supply stronger defenses against financial institutions and legal insurance claims. Several overseas trusts profit from statutory protections that make it hard for financial institutions to access your properties, even in bankruptcy scenarios.

Furthermore, the separation of legal and useful ownership implies that, as a beneficiary, you do not have direct control over the properties, making complex any kind of efforts by creditors to take them. Lots of offshore jurisdictions likewise restrict the moment structure in which asserts can be made versus trusts, adding one more layer of safety. By leveraging these lawful defenses, you can greatly enhance your financial stability and protect your wide range from unforeseen dangers.

Personal Privacy and Discretion Benefits

Establishing an overseas depend on not only provides durable lawful defenses but additionally assures a high level of personal privacy and confidentiality for your assets. When you established an offshore depend on, your economic events are protected from public examination, aiding you keep discernment concerning your riches. This discretion is crucial, especially if you're concerned concerning potential legal actions or unwanted focus.

In several overseas jurisdictions, laws protect your personal information, meaning that your assets and monetary transactions remain exclusive. You will not have to bother with your name appearing in public records or economic disclosures. In addition, dealing with a reputable trustee ensures that your info is dealt with securely, further enhancing your personal privacy.

This level of confidentiality enables you to manage your wide range without concern of exposure, supplying assurance as you guard your monetary future. Inevitably, the privacy benefits of an overseas trust can be a significant benefit in today's increasingly clear world.

Tax Benefits of Offshore Trusts

One of one of the most compelling reasons to consider an offshore trust fund is the capacity for significant tax benefits. Establishing up an offshore depend on can help you lower your tax obligations legally, depending upon navigate to this site the territory you pick. Many overseas jurisdictions provide beneficial tax obligation prices, and in many cases, you may also benefit from tax exceptions on revenue generated within the count on.

By transferring properties to an overseas trust, you can separate your personal wealth from your gross income, which might decrease your total tax obligation concern. Furthermore, some territories have no resources gains tax obligation, permitting your financial investments to expand without the prompt tax obligation effects you would certainly encounter locally.

Property Diversification and Investment Opportunities

By creating an offshore depend on, you open up the door to property diversification and distinct investment chances that might not be offered in your house nation. With an overseas trust fund, you can access various international markets, permitting you to spend in property, stocks, or commodities that could be restricted or less desirable locally. This international reach aids you spread out threat look at these guys throughout different economic climates and markets, securing your riches from local economic downturns.

Moreover, overseas depends on frequently provide accessibility to specialized investment funds and different possessions, such as exclusive equity or hedge funds, which might not be offered in your home market. This strategic strategy can be important in maintaining and growing your wide range over time.

Succession Preparation and Wealth Transfer

When taking into consideration how to hand down your wealth, an overseas trust can play an essential function in reliable succession preparation. By establishing one, you can ensure that your assets are structured to offer your loved ones while reducing possible tax ramifications. An overseas trust enables you to determine how and when your beneficiaries obtain their inheritance, providing you with satisfaction.

You can appoint a trustee to handle the depend on, guaranteeing your wishes are performed also after you're gone (offshore trusts asset protection). This arrangement can likewise shield your assets from creditors and legal obstacles, guarding your family's future. Additionally, offshore depends on can supply personal privacy, keeping your monetary matters out of the general public eye

Inevitably, with mindful preparation, an offshore depend on can work as an effective device to facilitate wealth transfer, guaranteeing that your legacy check these guys out is preserved and your liked ones are looked after according to your dreams.

Selecting the Right Jurisdiction for Your Offshore Trust Fund

Picking the ideal jurisdiction for your offshore depend on is a vital element in maximizing its advantages. You'll desire to consider variables like lawful structure, tax obligation ramifications, and possession security laws. Different jurisdictions offer differing levels of privacy and stability, so it is vital to study each choice completely.

Search for places known for their favorable trust regulations, such as the Cayman Islands, Bermuda, or Singapore. These territories usually provide durable legal protections and a credibility for financial security.

Additionally, believe about accessibility and the convenience of managing your count on from your home nation. Consulting with a lawful expert specialized in overseas depends on can guide you in guiding via these intricacies.

Eventually, choosing the ideal territory can enhance your property security approach and assure your wealth is protected for future generations. Make informed choices to secure your economic legacy.

Regularly Asked Questions

Can I Establish up an Offshore Count On Without a Legal Representative?

You can technically establish up an offshore trust fund without an attorney, yet it's dangerous. You could miss important lawful subtleties, and issues can arise. Employing a professional assurances your trust fund adheres to laws and safeguards your passions.

What Takes place if I Relocate To One More Nation?

Are Offshore Trusts Legal in My Country?

You'll need to examine your neighborhood regulations to determine if offshore depends on are lawful in your country. Regulations differ extensively, so seeking advice from a lawful specialist can aid assure you make educated decisions concerning your possessions.

Just How Are Offshore Trust Funds Regulated Worldwide?

Offshore counts on are regulated by international legislations and standards, differing by jurisdiction. You'll discover that each nation has its own policies regarding taxes, reporting, and compliance, so it's necessary to comprehend the specifics for your situation.

Can I Access My Possessions in an Offshore Depend On?

Yes, you can access your properties in an overseas count on, but it relies on the count on's structure and terms. You must consult your trustee to comprehend the specific processes and any restrictions involved.

Verdict

To sum up, overseas depends on can be a wise selection for safeguarding your wide range. When thinking about an offshore trust, take the time to select the best jurisdiction that straightens with your goals.

Report this page